ABOUT THIS CONTENT

Structure – Conduct – Performance is a framework used for industry situation analysis that provides a complete understanding of current industry structure, players, conduct and their competitive performance over time.Subject: Strategy/Frameworks

Table of Contents

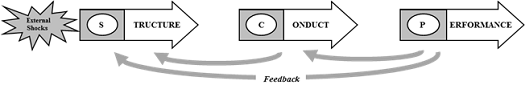

Structure – Conduct – Performance is a framework used for industry situation analysis that provides a complete understanding of current industry structure, players, conduct and their competitive performance over time. The assumption with this framework is that the performance of companies is determined largely by companies’ conduct and, ultimately, industry structure. The SCP model is used for gaining an overall understanding of an industry and provides a dynamic view of industry structure.

Structure

Economics of demand

- Availability of substitutes

- Differentiability of products

- Rate of growth

- Volatility/cyclicality

Economics of supply

- Concentration of producers

- Import competition

- Diversity of producers

- Fixed/variable cost structure

- Capacity utilization

- Technological opportunities

- Shape of supply curve

- Entry/exit barriers

Industry chain economics

- Bargaining power of input suppliers

- Bargaining power of customers

- Information market failure

- Vertical market failure

Conduct

Marketing

- Pricing

- Volume

- Advertising/promotion

- New products/R&D

- Distribution

Capacity change

- Expansion/contraction

- Entry/exit

- Acquisition/merger/divestiture

Vertical integration

- Forward/backward integration

- Vertical joint ventures

- Long-term contracts

Internal efficiency

- Cost control

- Logistics

- Process R&D

- Organization effectiveness

Performance

Profitability

- Profitability

- Value creation

Technological progress

Employment objectives

Methodology

- Study basic conditions. Study current and past events relevant to the course of the industry.

- Examine industry structure. Study industry reports, examine recent changes to the industry structure, and link changes to external shocks.

- Examine and predict conduct. Study recent conduct and identify links to changes in industry structure (past or anticipated), and predict changes in conduct.

- Examine and predict performance. Study performance of individual companies linking it to the basic conditions and the following structure and conduct. Predict future performance of the individual companies.

Strengths

- Very useful in showing causality

- Considered superior to other general models for industry analysis because it can be used in static and dynamic industry settings. Explicitly treats behavior and performance of individual companies and can be widely applied to many industries

- Has sound academic, theoretical and empirical backing

- Provides a framework for integrating other existing economic models (industry cost curve, Economic value to customer (EVC), Porter model)

Weaknesses

- Requires large amounts of analyses

There Are No Comments

Click to Add the First »

Click to Add the First »